Use your power to make a difference by joining our Let's Do Good initiative.

Make a Difference with NGO Donations - #OneDayForFuture

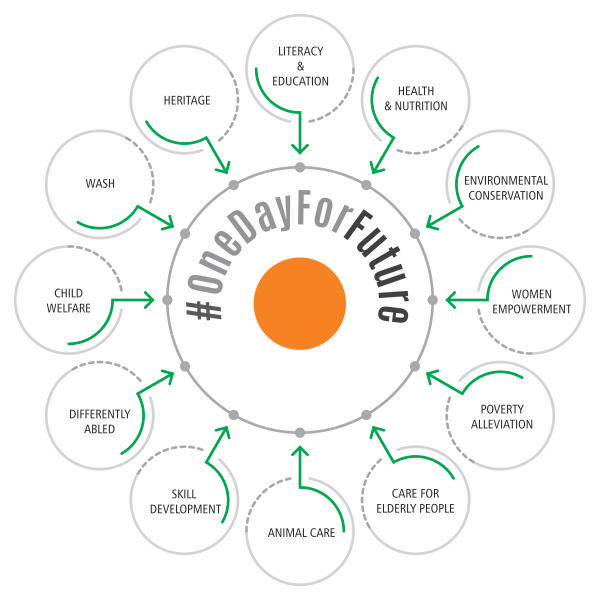

Donating or volunteering your time can change people's lives and improve the globe. We cordially encourage you to support the NGOs associated with i2u Social Foundation by participating in the #OneDayForFuture initiative. We will pair you with NGOs that are involved in the 12 main social concerns that you have selected. With real-time transparency on your dashboard, your contribution—whether it be a day's income or your time—will produce a sustained effect.

Donations for NGOs in India: Double the Impact, Save on Taxes

Donations to NGOs in India are made easier with the help of our user-friendly web platform. You may join a growing community of changemakers supporting hundreds of NGOs affiliated with i2u Social Foundation and contribute to causes that are important to you with just a few clicks.

Due to i2u Social Foundation's registration under Sections 12A and 80(G)(5) of the Income Tax Act, you can deduct 50% of your donation from your taxes, up to a maximum of 10% of your adjusted gross total income. By donating to an NGO now, you may support important causes and claim tax benefits while receiving an instant receipt and 80G certificate.

Volunteer for NGOs : Skill-building, Community Impact

With our volunteer certificate program , you may acquire new abilities, information, and experience. Utilize your passion or professional experience to better communities by volunteering around your choice with one of our partner NGOs. Contribute to #OneDayForFuture, have a real influence, and get a volunteer certificate from the sponsored NGO and i2u Social Foundation.

Be the Change You Wish to See

Your volunteer work or donation for NGO can have a good knock-on effect. Participate in the #OneDayForFuture campaign, use our platform to donate to reputable NGOs, and help create long-term solutions that improve communities all around India.

Join us to contribute

Little Help Goes A long way. Donate in donation/ time or kind. To know more, click here

#OneDayForFuture

Come and join the 300+ well-wishers! Be a Changemaker! Lets build a better tomorrow. Together.

Questions related to tax exemption