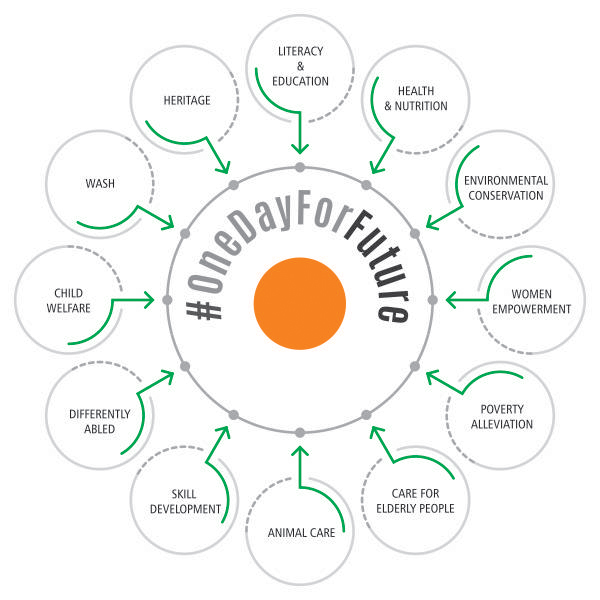

Use your power to make a difference by joining our Let's Do Good initiative.

Donations Eligible Under Section 80G of Income Tax

Monday , 12 February 2024- 5 min. read

In India, charitable contributions encourage social responsibility and offer significant tax benefits under Section 80G of Income Tax Act, of 1961. This clause offers individuals and organizations tax exemptions while promoting donations to NGOs and charitable organizations.

What Is Section 80G?

Taxpayers may deduct contributions made to certain charitable funds and organizations under Section 80G. Depending on the receiving institution, deductions can be made with or without restrictions and can range from 50% to 100%.

In a nutshell, section 80G benefits society as a whole by helping charitable organizations and encouraging philanthropy. The government provides donors with tax benefits to promote more charitable contributions.

Eligibility and Types of Donations

Section 80G allows businesses and individuals to deduct contributions made to approved charitable organizations. Hindu Undivided Families (HUFs), businesses, non-resident Indians (NRIs), and other entities are also qualified.

Please take note that not all donations are eligible for Section 80G deductions. The only eligible contributions are those that have been made to designated funds or organizations. Before donating, it is crucial to confirm the eligibility of each fund or institution and the maximum deduction amount.

Claiming Deductions:

Taxpayers must include all relevant information about their donations in 'Schedule 80G' of the Income Tax Return (ITR) form to qualify for deductions under Section 80G. The deduction could be 50% or 100% of the total amount donated, depending on the charity or fund to which it is made.

Recent updates state that donors need to submit a TDS-like certificate that the recipient organization or non-profit obtained through the e-filing portal of the Income Tax Department.

Mode of Payment:

Donations can be made by demand draft, electronic transfer, or cheque for Section 80G deductions. Cash donations up to Rs. 2,000 are also accepted; contributions beyond this limit must go through other approved channels.

Documents required to claim a tax deduction on donations:

To be eligible for deductions under the law, donors must have a donation receipt that includes:

- Duly stamped receipt:

Obtaining a receipt issued by the charity/trust to which you donate the amount is mandatory. The receipt should include details such as your name, address, amount donated, PAN number of the trust, etc.

- Form 58:

Form 58 is required when a donor intends to claim a 100% deduction.

- Registration number of trust:

All eligible trusts under this section are provided with a registration number by the Income Tax Department. Donors should ensure that the receipt contains the trust registration number.

Key Points to Remember:

- Not every donation is eligible for a Section 80G deduction.

- Receipts must include the institution's Section 80G registration number and all pertinent information.

- Before donating, taxpayers should confirm the eligibility and deduction cap of each organization or fund.

- When filing an ITR, accurate documentation is essential for claiming deductions under Section 80G.

In conclusion, using Section 80G's tax exemption benefits on contributions to non-governmental organizations helps people and the community at large, while also providing significant tax benefits for the donors. Understanding the provisions and requirements outlined under Section 80G allows individuals and organizations to optimize their tax liabilities while simultaneously effectively supporting charitable causes.

If you seek to make a donation but are unsure of which channels to go through then look no further than i2u Social Foundation. With a network spanning over 150 verified NGOs across India, our platform offers diverse opportunities to contribute to causes close to your heart. Through us, your donations will reach reputable and impactful organizations, ensuring that they make a tangible and lasting impact on society.

FAQs

1. Are there any new developments or revisions to the Section 80G tax exemption benefits for donations to non-governmental organizations?

Yes, according to recent updates, donors must provide a TDS-like certificate that the recipient institution or NGO obtained via the Income Tax Department's e-filing portal. Furthermore, some funds are no longer eligible for deductions under Section 80G, including the Prime Minister's National Relief Fund and the National Defence Fund.

2. What are the necessary documents to submit a claim for Section 80G tax deductions?

Donors require a donation receipt containing important information like the institution's PAN, Section 80G registration number, and the donation amount to claim a tax deduction under that section. A photocopy of the institution's 80G registration certificate is also required to substantiate the claim.

3. Does anyone qualify for Section 80G tax exemptions on donations made to non-governmental organizations?

Under Section 80G of the Income Tax Act, people, businesses, firms, Hindu Undivided Families (HUFs), Non-Resident Indians (NRIs), and other entities may claim tax exemption benefits on donations made to qualified charitable institutions or funds.

4. Which donations are eligible for Section 80G deductions?

Section 80G allows for the deduction of cash, cheques, or electronic transfer donations made to designated charity funds or institutions. Donations exceeding Rs. 2,000 in cash, however, are not deducted from taxes.

5. How do donors determine the amount that is deductible under Section 80G?

By figuring out the qualifying limit using their adjusted gross total income, donors can compute the deduction amount under Section 80G. Depending on the qualifying limit that applies to each institution or fund, the deduction can be either 100% or 50% of the total amount donated.

.jpeg)